Koblenz, the night of December 29, 2022: A security guard makes his rounds. He encounters individuals preparing to detonate an ATM, is assaulted, forced to lie on the floor in the guardroom, and witnesses the explosion just a few meters away. The aftermath: the security guard suffers bruises, a blast trauma, and is rushed to the hospital in severe shock. Unfortunately, this is not an isolated incident. In 2022, Germany witnessed 660 physical attacks on ATMs, resulting in approximately €30 million in damages, as reported by the Federal Criminal Police Office in its “Situation Report on Attacks on ATMs.” This marks a 14% increase from the previous year and is the highest recorded since the data collection began in 2005. The trend is clear: an increase in explosive attacks, which can cause significantly greater damage than blast traumas, especially when criminals mix their own explosive compounds, risking unpredictable force and potential secondary explosions.

Equipping ATMs with ink cartridges countrywide? Tedious, expensive, and not secure enough

How can banks deter criminals from ATM attacks with explosives during the night, especially in remote areas where there are no people on the streets after hours? The crime can be meticulously planned, even comfortably indoors if the bank branch has a self-service area that customers can access around the clock with their bank card. Closing the self-service areas after business hours for the entire evening and night is one security measure, but some banks implement it reluctantly due to the potential dissatisfaction of customers. The demand for an alternative is prominent. Current solutions include ink cartridges in ATM cash cassettes, marking the money unusable after an explosion. While this measure may discourage criminals, it does not guarantee reliable protection. Moreover, it is expensive for banks to retrofit ATMs nationwide, as only personnel with explosive permits under §20 of the Explosives Act are authorized to handle the cartridges.

Using automatic rolling shutters? The solution often fails due to security cameras and motion detectors

Another potential solution to protect banks from ATM explosions is by not directly closing the self-service area with the branch but using rolling shutters during critical times, such as after midnight. However, who wants employees to patrol branches at that hour? Automatic rolling shutters seem convenient, but their effectiveness relies on the security system’s ability to detect whether anyone is still present in the area – a customer withdrawing money late at night or a homeless person using the self-service area for shelter.

Activating rolling shutters in an empty space at midnight is an easy task for automation, but finding sensors that reliably determine whether the space is genuinely empty poses a challenge. Traditional security cameras and motion detectors quickly reach their technical limits, especially in poor lighting conditions and when people sleeping on the floor are not moving. This could quickly lead to an unwanted lock-in.

An alternative to traditional cameras offers a solution: LiDAR sensors

LiDAR sensors emit laser beams, capture reflections, and create real-time 3D maps of environments based on the light’s travel time. An analysis software precisely detects objects and individuals within the data, even in darkness. Facial recognition is excluded due to the three-dimensional nature of the data, ensuring data protection compliance. Therefore, LiDAR sensors are well-suited to be part of an automated security system with rolling shutters to protect banks from ATM attacks with explosives.

Due to their compact size, banks can easily mount these devices in corners of ATM rooms and connect them to their IT system via Ethernet, similar to traditional surveillance cameras. From there, LiDAR sensors oversee the entire self-service area.

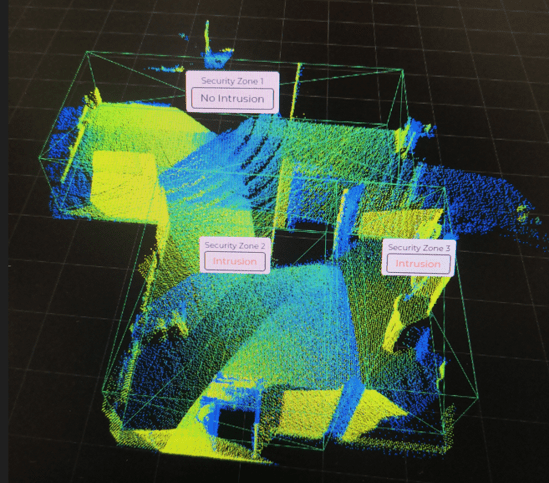

Here’s how a modern security solution with LiDAR sensors works in daily life to protect banks from ATM attacks: The sensors conduct tens of thousands of measurements per second in the self-service area. An on-device perception software converts the measurements into a real-time 3D point cloud. In the next step, the software saves the representation of the empty space. When the bank integrates the program into the building automation system through web I/O interfaces, rolling shutters can automatically close at a specified time – provided the software detects no deviations in the 3D image from the LiDAR sensors, such as a person sleeping on the ground.

Thanks to the three-dimensional nature of the data, the system reliably and directly detects whether objects are present in the security zones without the need for additional interpretation steps, as required with 2D camera data. With the use of LiDAR sensors, it is nearly impossible for individuals to be trapped in the self-service area by the system. Instead, in such cases, the building automation system sends a warning message to the security service, which resolves the situation on-site and manually closes the rolling shutters. In any case, after the area is sealed off, attackers cannot enter.

3D LiDAR as an efficient security solution against ATM attacks

The threat of ATM attacks with explosives is growing, forcing banks to strike a balance between security and extended self-service hours. This is effectively achieved with automatic rolling shutters equipped with LiDAR sensors. These sensors offer more reliable detection of objects and individuals compared to 2D cameras, even in darkness. They operate in compliance with data protection regulations, are compact, and can be easily retrofitted. Banks thus gain an efficient security solution with a quick return on investment by employing these sensors.